A Look at the City of Sammamish’s 2025-2026 Biennial Budget

A structural imbalance leads to new taxes, but will they close the gap?

The City of Sammamish’s 2025-2026 Biennial Budget acknowledges a looming financial crisis in its Introduction: “....the structural imbalance verified by the Fiscal Sustainability Task Force remains. The analysis shows that at the current levels of service, the City will use up all of its ending fund balance, including its Council-adopted reserves, by 2029.”

This article reports on:

The City’s financial forecast from 2025 to 2030.

Operating and capital expenses in the 2025-2026 budget, and their sources of funding.

New taxes enacted and under consideration by the City Council.

Will public investment reap private benefits? A fair question to ask.

Comparison of revenues vs. expenditures over a ten-year period (in Appendix).

Long-term financial forecast shows the City depleting its reserves by 2029

The 2025-2026 Biennial Budget reflects the urgency the City Council faces in rising expenditures and the dwindling fund balance.

When the City transfers money from its reserves, it is similar to you transferring money from your savings to your checking account so that you can pay your bills. Similar to your bank accounts, maintaining a fund balance is necessary to ensure your account is not overdrawn.

The below chart and accompanying graphic summarize the details of the City’s Long Term Financial Forecast on page 174 of the 2025-2026 Biennial Budget.

What are the operating & capital expenses, and their funding sources, for 2025-2026?

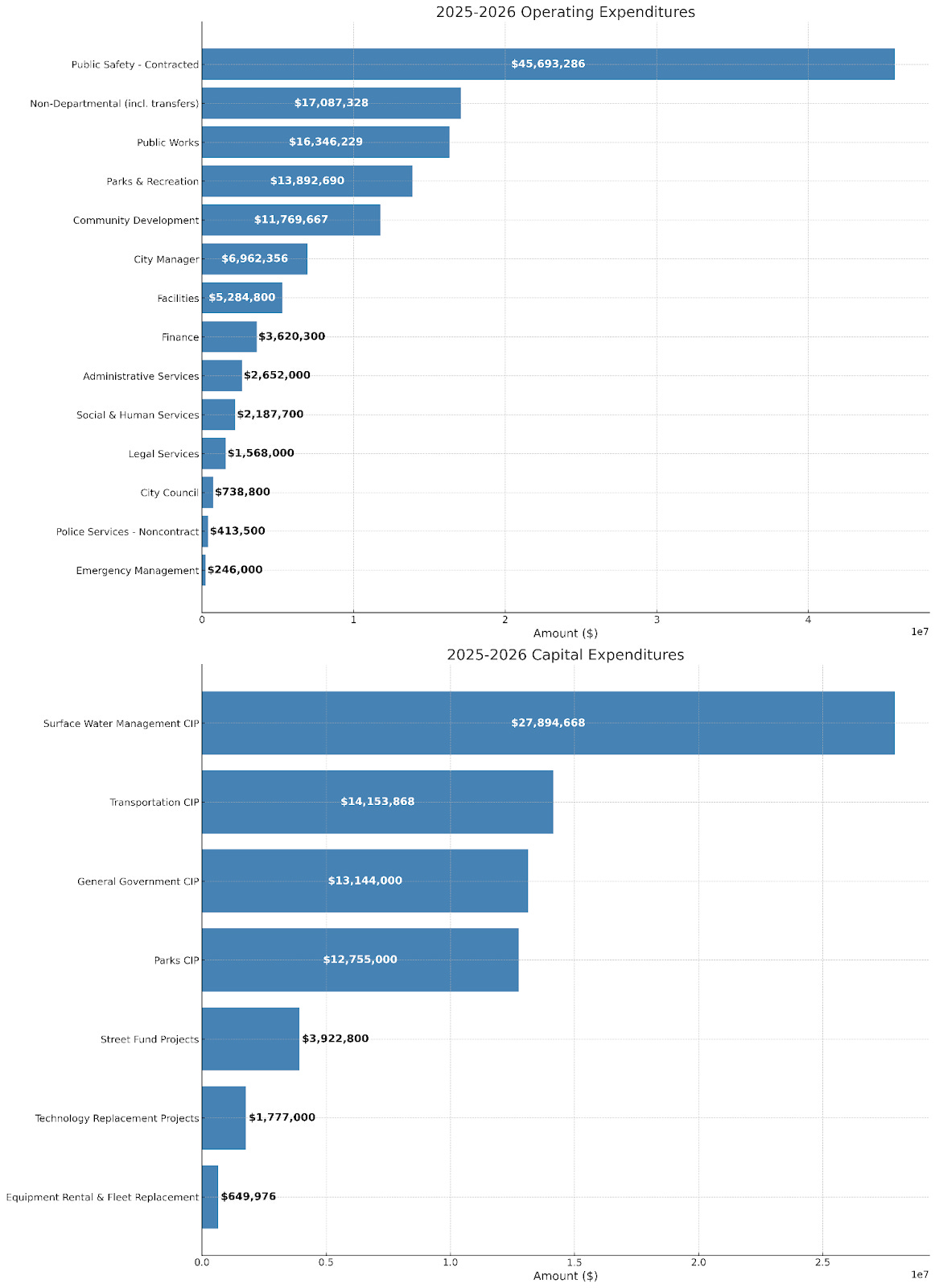

This chart represents the operating and capital expenditures budgeted over two years and was created with the help of AI technology.

This next chart represents the sources of funding for the operating and capital expenditures budgeted over two years and was also created with the help of AI technology.

City Council considers new taxes

The City Council voted in November last year to levy the allowable 1% increase in property taxes for 2025. This was a unanimous vote.

Still faced with a budget shortfall, the City Council is looking for additional revenue, passing one tax bill and looking into another. They are both described here:

Utility Tax passed

On March 18, 2025, the Sammamish City Council adopted Ordinance No. O2025-580, implementing a 6% utility tax on electricity, gas, telecommunications, cable, water, sewer, stormwater, and solid waste services effective January 1, 2026. The tax is projected to generate approximately $11 million annually and includes provisions for a low-income rebate program offering $200 annually to qualifying households.

From March 18, 2025 City Council Regular Meeting Minutes:

MOTION: Deputy Mayor Amy Lam moved to amend Ordinance O2025-580 to increase the annual low-income rebate from $100.00 to $200.00. Councilmember Pam Stuart seconded. Motion carried unanimously 7-0.

MOTION: Councilmember Kali Clark moved to adopt amended Ordinance O2025-580 implementing a six percent utility tax and a six percent use tax on brokered natural gas. Councilmember Roisin O'Farrell seconded. Motion carried 6-1 with Councilmember Kent Treen dissenting.

Metropolitan Park District Tax under consideration

The Sammamish City Council has directed city staff to explore the creation of a Metropolitan Park District (MPD) — a new tax entity that would dedicate revenue to parks and public spaces. The proposal comes with a promise to fund long-term projects like a civic plaza or public square in the Town Center.

The proposed MPD would require voter approval, and the tax would exist in perpetuity – there is no renewal requirement. If passed, it could levy up to $0.75 per $1,000 of assessed home value. The Council could consider a more modest rate of $0.30 per $1,000 based on practices in other Washington cities, which would cost the owner of a $1.5 million home about $450 per year. Based on Sammamish’s current tax base, this would generate an estimated $7.5 million per year in new revenue. This new revenue would be restricted to use for parks expenses only, similar to how stormwater revenue and expenses are treated.

As a point of reference, the City’s 2025-2026 budget projects just $450,000 per year in parks impact fees1, a fraction of what is needed for major capital projects. The question remains on how to continue to upgrade, expand, and improve the City’s parks, be it from the depleting general fund, or new taxes imposed on Sammamish’s residents.

Public or private benefit?

Of immediate concern is that this public investment in parks may directly benefit private developers. For example, the Town Center developer would stand to profit from a taxpayer-funded civic square that is adjacent to the Town Center’s retail and housing development.

It is likely that in your neighborhood, there is a community park that the developer built, along with the new roads leading to your neighborhood. Your taxpayer dollars are used to maintain the parks and roads in your neighborhood, but your dollars probably did not go towards their construction.

In the face of the City’s impending financial crisis, the question of who should be paying for the development of roads and parks in the Town Center is a fair one to ask. The Town Center straddles between being a civic center for Sammamish’s residents and being a profitable venture for the Town Center developer. The lines are being blurred on who is paying for its new roads and parks. I covered these concerns in these two previous articles, which I hope you will revisit after reading this article about the City’s worrisome financial situation.

Lastly, here is the link to the City’s Budget Documents, the source material for this article.

APPENDIX

Comparison of Revenues vs. Expenditures over a 10-year period

The data in this chart and the accompanying visualization were taken directly from the budget documents. The use of fund transfers enables the City to offset the “Total Budget Uses” with “Total Available Funds”.

As referenced in the Financial Forecast chart in the article, the available fund balance used by the City to offset the deficit is projected to be depleted to the amount of –$3.352 million in 2029.

This visualization looks only at Total Revenues versus Total Expenditures (Uses):

Impact fees are fees charged to developers to cover, in whole or in part, the anticipated cost of improvements borne by the city that will be necessary as a result of the development.